How the US can make nuclear energy cheap again

Why nuclear power

The ideal power source is affordable, emission-free, reliable, scalable, grid-compatible, and has a small footprint. It’s widely recognized that nuclear power excels in all of these except affordability. Critics argue that nuclear power is too expensive and takes too long to build. But is it possible that nuclear power might actually be the cheapest way to generate electricity?

Many believe solar and wind power are the ideal power sources, but they fail on all six of these criteria. The claim that solar and wind power are cheap is based on a cost formula that excludes the hidden costs necessary to make them reliable every hour of the year. Two papers by this author explain the problems in great detail.1,2

These papers show that the cost and land use of solar and wind power rises exponentially as their percentage of use increases. The cost of solar power at 100% reliability is about $488/MWh (10 times the cost of natural gas). When factoring in all the life cycle emissions from overbuilding and the batteries necessary to make solar power 100% reliable, emissions are about 120 grams CO2/kWh (about 25% of natural gas). These results were derived by simulating two years of hourly data from all the solar farms in the Midwestern states, using current pricing for batteries and solar farms.

The transition to solar and wind power is not proceeding as well as expected, prompting renewed interest in nuclear power. Figure 1 below, from the Department of Energy’s recent nuclear liftoff report shows that nuclear power gets a perfect score, while onshore renewables score high only for being clean.3

Big tech companies aim to power their data centers with zero-carbon electricity, and they are discovering the limitations of relying on solar and wind power. This has prompted them to make significant investments in nuclear power. For example, Microsoft is funding a restart of Three Mile Island Unit 1, and Amazon is investing in X-energy and considering using their reactors to power its data centers.

The reason for big tech’s sudden interest in nuclear power is that data centers cannot afford to be subject to blackouts, brownouts, or demand response programs. Additionally, solar and wind power are not entirely clean because they still require fossil fuel backup. This prevents big tech from earning the zero carbon label. Furthermore, data centers will increase electrical demand, and it is becoming increasingly difficult to connect new intermittent energy sources to the grid.4

Despite this renewed interest, the primary challenge for nuclear energy remains its cost. Lowering the cost of nuclear power is essential for a successful transition to a low-carbon future. While most people support climate mitigation, polls show they will choose warming over a lower standard of living. This paper will show that nuclear power was once cheap, explain why it became expensive, and show how to make it cheap again.

Why nuclear power became expensive in the US

The first full-scale nuclear reactor for peaceful purposes was the Shippingport Atomic Power Station, which began supplying electricity to the Pittsburgh area on December 18, 1957. The initial era of commercial nuclear power in the US spanned from 1964 to 1967, during which 14 reactors were built. However, due to unclear cost data from this early period, our cost analysis will start from 1967 to the present, where comprehensive data is available.5

1967 marked a golden era for nuclear power in the US, with nine reactors starting construction at an average cost of $1,352 per kW when they go online. The reactors took an average of 6.3 years to build. All costs in this section have been converted to 2024 dollars using a GDP deflator6, and all capital costs include interest during construction.

The first plant starting construction in 1967 was Palisades. Palisades cost $1,170 kW, went online on New Year’s Eve in 1971, and took about 5 years to build. It operated for 50 years before being prematurely shut down in 2022. Palisades is now scheduled to be restarted in 2025 and is expected to run for another 25 years.

Table 1 above puts the early cost of early nuclear power in perspective by comparing it to modern alternatives.7 The capital costs of early nuclear power are comparable to the capital costs of a modern combined cycle gas plant. However, the levelized cost of early nuclear energy is cheaper due to its lower fuel cost. Comparing nuclear power to wind and solar energy is complex because to make the latter as reliable as nuclear will require extensive over building, batteries, transmission upgrades, and an underutilized fossil fuel backup system. But even the capital costs of early nuclear power were cheaper.

Today nuclear power is seen as a way to address climate change, but in the early days it was seen as the cheapest way to provide electrical power. Unfortunately, the low cost of nuclear power would not last. From 1968 to 1970 prices begin to rise modestly. From 1967 to 1971, 47 reactors had started construction where the average price would be $2,588 kW after going online. Even at this higher price, however, the levelized cost of nuclear energy is still competitive with natural gas combined cycle and significantly cheaper than any other alternative. And as a bonus it is emission free.

The main cause of higher prices in this time period was primarily due to growing pains in this nascent industry. Here is a description taken from the Atomic Energy Commission (AEC) report of 1970:8

"In early 1968, most utility executives expected that their nuclear plants for commercial operation in 1969 and 1970 would be on schedule. In contrast to the confidence expressed at that time, it now appears that only two of those 13 plants will be on the original schedule. The other 11 plants are experiencing delays of from about 2 to 13 months, due to many reasons, such as late pressure vessel deliveries, regulatory requirements and proceedings, but predominantly due to the lack of experience in building nuclear plants and the inability to obtain experienced labor and craftsmen during the construction phase."

These issues are not surprising considering that nuclear energy was growing rapidly with 47 reactors under construction in 1970. These kinds of problems resolve themselves over time, but 1970 would be a pivotal year for nuclear power with passage of the National Environmental Policy Act (NEPA).

Following the passage of NEPA, the Atomic Energy Commission (AEC) revised its licensing rules to comply with the new law. The Calvert Cliffs' Coordinating Committee, comprised of local civic groups, the Sierra Club, and the National Wildlife Federation, argued that these new AEC rules were inadequate and violated NEPA's Environmental Impact Statement requirement. The committee filed a petition in the court of appeals against the AEC, seeking a review of the rules and arguing that the AEC's process was contrary to NEPA's text and intent.

This legal challenge ultimately led to the landmark 1971 Calvert Cliffs decision, where the D.C. Circuit Court ruled that the AEC was required to strictly adhere to each procedural step mandated by NEPA. The decision had far-reaching implications for environmental law and the implementation of NEPA across federal agencies.

In response, the AEC halted the licensing of all nuclear plants for 17 months to modify its licensing rules to comply with NEPA. The decision affected 97 reactors in various stages of permitting, construction, and licensing, initially adding two years to every nuclear plant's construction time.9

Ironically, the AEC's new NEPA regulations made it more difficult to build nuclear plants than coal-fired ones. This is contradictory considering that the point of NEPA is to protect the environment, and nuclear power is emission-free, while coal power is the dirtiest form of electrical generation. The primary environmental concern related to nuclear power under NEPA is its clean, but warm water discharges.

1974 was bad year for nuclear power. New regulations are piling up, inflation reached an all-time high of 12.3%, and demand for electricity was falling. Here is a quote from the AEC report of 1974:10

"During 1974, two entirely unexpected developments occurred in the complicated economic structure of the power generation field to depress the historic growth pattern of the industry. The first of these was a drop in demand for electric power, generated by pleas for conservation efforts and by consumer reaction to higher electricity bills. The second was related to inflationary pressures, which placed many utilities at a disadvantage in raising new capital. Utilities which saw the impending erosion of projected markets for power, together with those which found themselves in financial straits, began to reduce power plant construction programs and to defer the building of new units. Nuclear units, in particular, were delayed because of their high capital costs, and because of their lengthy construction periods. By the end of September 1974, electric utilities had deferred construction of 70 previously-ordered power reactors, and had cancelled plans for nine nuclear units previously ordered."

The last era of nuclear energy, until modern times, was 1975 to 1978, during which 19 reactors would begin construction. Beginning in 1975, the NRC replaces the AEC. The AEC was seen as conflicted due to their balance of regulating nuclear power and promoting it; the NRC would focus solely on safety.

1979 was the date of the Three Mile Island (TMI) accident, where unit 2 had a partial core meltdown. No plant will start construction after this date until 2013, with the start of construction for Vogtle 3 in Georgia. Costs of plants under construction after the accident rose astronomically.

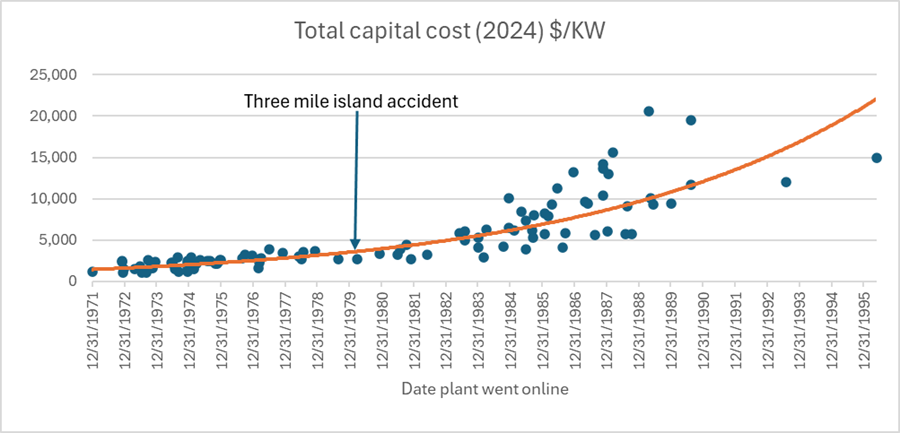

The historical price escalation of nuclear power is shown in figure 2. Here we look at nuclear plant costs with respect to the date construction began. Each dot is a nuclear power plant. The red line shows the best fit trend line.

In figure 2, note the blank area following the Calvert Cliffs decision. Before the Calvert Cliffs decision, we have two outliers: Diablo Canyon 1 and 2. There were some legitimate seismic concerns due to the discovery of the Hosgri Fault. The plants had to be upgraded, but in addition, activist groups like Friends of the Earth used every tactic available to stop the operation of the plants. Diablo Canyon 1 finally went online in 1985 and 2 in 1986. It took about 17 years to build unit 1, and 15 years to build unit 2. The plants cost about $8,000 kW each, four times the cost of other plants built in the same time period.

Figure 2 shows that the cost of nuclear power becomes unstable after the Calvert Cliffs decision, but there are two other factors contributing to the cost escalation: the TMI accident, and the number of regulations is escalating every year. To see the effects of the TMI accident we look at the cost with respect to the dates the plants went online, as depicted in figure 3.

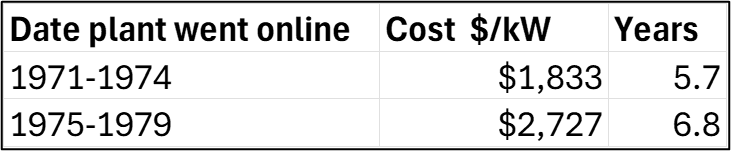

Figure 3 shows that plants which managed to come online before the TMI accident or shortly thereafter, were able to keep costs well below $5,000 kW. Table 2 below shows the average costs of plants that went online before the accident vs after. BWR means Boiling Water Reactor, and PWR means Pressurized Water Reactor. Years means years to build.

Table 3 breaks down costs within the era of plants that went online before the accident. Here we isolate effects that had nothing to do with the TMI accident. Costs are slowly rising throughout this time period, but average prices in the 1975 to 1979 era are still competitive compared to modern gas plants when factoring in the lower fuel costs.

Figure 4 shows the years to construct with respect to the starting date of construction.

Concerns over the increasing regulations during the period from 1970 to 1979 are discussed in this historical document.11 Figure 5 below shows the annual increase in regulatory guides (RGs) and branch technical positions (BTPs). RGs and BTPs are documents written first by the AEC, then by the NRC, to inform nuclear power providers on how to comply with new regulations. The number of these documents gives us an idea of the number of new regulations coming out each year. Note that regulations accumulate, so the guides that had to be processed went from 4 in 1970 to about 250 in 1979, all before the TMI accident.

It is important to understand that the new regulations during this period were not just for new plants but also applied to plants under construction. This caused plants to delay construction and, in many cases, to upgrade their designs. This goes a long way in explaining why plants are taking longer to build over time. After the TMI accident things get exponentially worse.

Shortly after the accident, a massive investigation ensued composed of a 12-member Presidential Commission (known as the Kemeny Commission), the NRC's Lessons-Learned Task Force, the U.S. Congress and its General Accounting Office, an independent Special Inquiry Group (known as the Rogovin Committee), and various other NRC task forces. The NRC consolidated the recommendations from the investigations into a document called the TMI Action Plan. This plan included approximately 371 individual requirements. When the NRC reviewed these 371 requirements against each nuclear power plant, they found that 13,863 action plan items were applicable.12

To gain a bit more insight into the cost escalation during the 1976 to 1987 era of extreme cost instability, let's focus on the cost inputs of building just the containment. Data for the containments built in this era comes from this study.13 During this era, the design of the containment did not change. Wages for iron workers rose, but that was more than offset by declines in costs for rebar, steel, and concrete. This implies that inflation wasn’t a material cause of the post 1976 cost increases.

There was, however, a substantial rise in the material deployment rate. This is a measure of how long it takes to install the materials from the day they arrived on site – it's a way of measuring worker productivity. Worker productivity fell by 40% for steel workers and 50% for concreate workers. This was the primary cause of the net increase in cost of building the containment. The main cause of the productivity decline appears to be the torrent of new regulations and public opposition following the TMI accident. This led to work stoppages, rework, management disarray, and low worker morale.

Figure 6 shows the inflation rate during the era of nuclear plant construction. Inflation has a particularly devastating effect on the cost of nuclear power because the largest cost component is interest, and inflation causes higher interest rates. Factors such as longer licensing processes, retroactive regulations, and public opposition, cause construction delays, and this compounds the effects of inflation.

Figure 7, from this article14, shows that productivity in construction has been falling since 1970. The cause is unclear, but the article suggests: “Syverson speculates that any combination of number of frictions may be at work, including but not limited to regulation, pushback from residents and officials, and weak incentives within the sector to avoid slowdowns and stoppages.”

This explanation nicely fits the experience of nuclear plant construction: increasing regulations and public opposition from activist groups, leading to construction delays. Apparently, many of the same difficulties affecting the building of new nuclear power plants are affecting all large construction projects.

The fracking revolution in the early 2000s dramatically lowered the cost of natural gas. This has played a significant role in keeping nuclear power from making a comeback. Natural gas also began to replace coal due to its lower price and CO2 emissions. In addition, with the rise of solar and wind power as the politically preferred solution to climate change, natural gas plays an essential role as backup due to its ability to rapidly ramp its power up and down. Blind faith in the ultimate ability of solar and wind energy to power a modern society leaves no room for nuclear power as an emission free alternative.

Figure 8 shows costs of nuclear power worldwide.15 The US saw the highest cost increases, but some countries managed to keep costs low. In 2010 South Korea was still building plants below $2,000 kW. The prices in this chart are 2010 dollars and don’t include interest during construction. To convert to 2024 dollars, multiply by 1.39; to include interest during construction multiply by 1.2. Thus, $2,000 in 2010 is $3,336 in 2024 dollars, including interest during construction.

Nuclear power in the early 1970s was the cheapest form of electricity. The US was on a fast track to a rapid transition to this emission-free source of energy. Instead, it was stopped by excessive regulation, regulation applied retroactively to plants under construction, opposition by activist groups, inflation during the 1970s, cheap natural gas, and faith in solar and wind power as a superior alternative. However, as the difficulties of relying on intermittent energy are becoming clearer, interest in nuclear energy is once again on the rise.

Standardization and modularization

Henry Ford once said, “Any customer can have a car painted any color that he wants so long as it is black.” Standardization as a way of reducing costs for nuclear power was proposed by the AEC back in the early 1970s. The idea is that once a design license is completed for the first version of a plant, future identical versions can skip that step. In addition, by building the same identical plant over and over, all the employees, including the suppliers, perfect their tasks – this is called industrial learning.

The AP1000 is a large 1017 MW reactor, and it is rapidly becoming a global standard. Recently, two AP1000s began operation in the US, while four are running in China, with an additional six in China under construction. Nineteen more are planned for Poland, India, Ukraine, and Bulgaria.16 In addition, China has built six reactors that are slight modifications of the AP1000 called ACP1000.

The AP1000 is a modular reactor, meaning the components of the plant are constructed in module factories and then delivered to a site where they are assembled into the finished plant. The goal of modularity is to reduce costs by building the pieces of the plant in factories where conditions are optimal.

The AP1000's simplified design requires less concrete and steel per unit of power capacity than other alternatives, featuring 50% fewer safety-related valves, 35% fewer pumps, 80% less safety-related piping, 85% less control cable, and 45% less seismic building volume.17 Could the AP1000 be the model T of nuclear power?

The first two AP1000s were built in Georgia, called Vogtle 3 and 4. The plants took eleven years to construct, and cost $18,500 kW (2024 dollars).18 This was just over twice the expected cost, and took about twice the expected time to build.

This price is extremely high by historical standards, recall that the cost of Palisades was $1,170 kW (2024 dollars). There are several primary reasons for the cost overruns:

These are first-of-a-kind and second-of-a-kind versions of a modular design.

The plants began construction before the design was completed.

Nuclear plants are more complicated to build today due to more regulations.

The US has forgotten how to build nuclear plants.

Productivity fell during the covid era.

The first-of-a-kind (FOAK) version of a modular design is going to be the most expensive because investments have to be made to build the module factories. To make these investments pay off many versions have to be built – this is very similar to cars and jets. In addition, it takes a while to perfect the task of manufacturing a particular product. As more versions are built, the cost will fall. Eventually, when costs stop falling, we say we have achieved nth-of-a-kind (NOAK) costs.

Many mistakes were made in the construction of these plants due to a lack of experience. For example, the rebar in the base mat for Unit 3 was improperly installed, which led to a six-month delay. Another six months were lost redoing improper welds. By starting construction without a completed design, any design changes that had to be made later required updating the design and other licenses. In addition, the changes caused ripples throughout the whole supply chain, requiring module makers to redesign their components as well – creating a chain reaction of construction delays.

Most of these problems are growing pains. In the pre-NRC days these kinds of problems would have been faster to fix as the AEC was more flexible. However, even with heighted regulations, with a completed design in hand, and more experience building the AP1000, fewer of these mistakes will be made in the future.

China recently had a much different experience building the AP1000. China has a reactor called the ACP1000, which is a slight modification of the AP1000. China built two of these reactors in Pakistan (KANUPP-2 and KANUPP-3), which came online in 2021 and 2022. Both reactors were built in less than six years, at a cost of $4,363 per kW.19 China was able to achieve this because there was a less bureaucratic regulatory process, an experienced workforce, strong domestic supply chains, prior experience from building similar reactors in China, and favorable government financing. This demonstrates that AP1000s can be built quickly and affordably. China will likely see even lower prices as they continue to build more versions of this design.

According to an MIT study (cited by the DOE), the projected NOAK cost of an AP1000 for the US is $4,625 kW.20 The analysis is done using their open source Nuclear Cost Estimation Tool (NCET). NCET is a computer model that uses historical data of nuclear plants built from around the world to predict costs of building nuclear plants under various scenarios. It predicts that building about 10-20 reactors is required to achieve NOAK. NCET only considers industrial learning, so with streamlined regulations perhaps we could get even cheaper. This price is bit higher than the Chinese built version, which isn’t surprising considering that China provides favorable financing for its nuclear projects.

$4,625 kW is higher than the price of nuclear power from the pre-TMI accident era, but it is still quite affordable. The AP1000 is expected to have a life of 80 years (possibly 100), a capacity factor of 93%, and low maintenance costs due to its simplicity. The levelized cost over an 80 year lifetime is projected to be $66 MWh. This is a bit higher than gas at about $44 MWh, but a fraction of 100% reliable solar power at about $488 MWh.21

Critics often claim that industrial learning doesn’t work with nuclear energy. They refer to the rise in historical prices that was explained in the previous section – they call this an example of negative learning. But they fail to understand the dynamics of why prices rose. The good news is that the regulatory environment post-TMI accident has substantially improved. When things finally calmed down after the accident, operations of nuclear plants began to experience dramatic improvement.

Figure 9 shows the steady rise in capacity factors in the US, which equates to lower costs.22 Capacity factors rose from about 50%, to an astonishing 92%. The US capacity factors are the highest in the world, proving that private ownership of nuclear power plants can produce low cost energy. This was achieved by adopting a continuous improvement strategy, deep cooperation among the nation’s nuclear plant owners, and greater regulatory stability – an example of industrial learning at its finest.

To dramatically lower the cost of building a new reactor design, we have a paradox – we have to build many versions of it, but no one wants to build the next few because the cost will be substantially higher than the NOAK cost. For most products, companies can afford to lose money on their new product until they reach NOAK. It’s an expected cost of doing business. But in the case of nuclear energy this cost is too high.

Westinghouse Electric, which designed the AP1000, went bankrupt by guaranteeing a price that could not be met. No utility so far is willing to step up and suffer paying high prices in the name of eventually getting to NOAK pricing. Why should they take the risk? They simply have no incentive to.

A simple solution to this paradox is that the federal government should offer a price guarantee until near NOAK is achieved. This can be justified because affordable nuclear energy is in the people’s interest. In addition, the nuclear power subsidies need only be temporary. Once NOAK is achieved the unsubsidized price will be very affordable. In contrast, solar and wind power are already at NOAK, their subsidies must be permanent in order to maintain the current incentives.

As the limitations of solar and wind power become clearer, nuclear energy is likely to be a hot product globally. It will not only provide affordable clean energy, but it can produce large numbers of high paying blue collar jobs. In addition, exporting nuclear plants can provide the US with enormous economic opportunities. If we don’t capitalize on this soon, the nuclear future will likely go to China.

To achieve the NOAK price for nuclear energy we should commit to constructing a fleet of AP1000s. Building one here and there will not achieve significant industrial learning. The quantity must be large enough to create a permanent, well trained workforce, and a mature supply chain that specializes in building nuclear power plants.

We should consider alternatives to the AP1000 as well, but since the AP1000 is a global standard, and since we have acquired some experience with this design, we should emphasize building it in the near future as this will give us the fastest opportunity of achieving near NOAK costs – nuclear power needs a win. When the market sees prices for large reactors stabilize, there will be an explosive demand for more, and this is likely to include other designs as well.

Lowering the cost components of reactors

To gain deeper insight into how to lower the costs of building a nuclear plant, we will examine each component of the total cost, then propose strategies to reduce the cost of that component.

The primary assumptions are taken from the previously cited MIT study.23 The costs in this section all assume that NOAK has been achieved, but perhaps we can lower costs even a bit more than what the study suggests. The reactor design is an AP1000 or similar reactor, life of the plant is 80 years, financing cost is 8%, financing period is 30 years, discount rate for present value calculations is 8%, total capital cost is $4,625 kW, operation and maintenance (O&M) is $12 MWh, fuel cost is $9 MWh, refurbishment cost is $6 MWh, and refurbishment costs are zero for the first 30 years.

Based on these assumptions, the levelized cost of electricity is $70.9 MWh for the first 30 years, then drops to $27.3 MWh for the next 50 years. This means that the retail price of electricity will rise by about 2 cents/kWh for the first 30 years, then fall below current prices by about 2 cents/kWh for the next 50 years.

The lifetime cost is $66 MWh. This cost is calculated by dividing the capital cost plus the present value of all the long term costs, by the present value of all the electricity the plant will ever produce. It can be argued that since they assumed borrowing costs are 8%, they should have used a discount rate closer to 6% to account for the effects of inflation of the long term cost items. The lifetime cost would then be $56 MWh. To be consistent with the study, we will use a discount rate of 8%.

Table 4 shows the cost of each component of the total cost based on the stated assumptions. These costs are the total incurred for constructing the plant then operating it for a lifetime of 80 years. The long term costs, such as O&M, are discounted to the present. Column 2 shows the present value of the lifetime costs for each component in 2024 dollars. Column 3 shows the cost as a percentage of the total.

The owner's cost is the cost that is mostly incurred before construction of the plant begins. This cost includes a decommissioning fund, purchase of the land, preparing the land, legal fees, taxes, switchyards, cooling infrastructure, transmission infrastructure, connection to utilities, seismic studies, NEPA review, and obtaining all of the NRC licenses (design, build, operating).

A high percentage of these costs are complying with regulations. Thus, streamlining regulations can lower them significantly. This will disproportionally benefit small reactors as their licensing cost is same as for large reactors. Another strategy is to build several units of large reactors on the same site to exploit economies of scale. The owner's cost is a semi-fixed cost, so the more power placed on a single site, the cheaper it is per unit of capacity.

The direct construction cost includes cost of parts, materials, equipment, and wages for construction workers. To reduce this cost, we must build plants on a regular basis to develop a highly trained and productive workforce. In addition, building multiple units on a single site and staggering their start dates can make optimal use of equipment, availability of skilled workers, while maintaining high worker productivity. Learning from building earlier units is directly transferred to later units. For example, the Barakah project in the United Arab Emirates, experienced a 40% reduction in labor costs between the construction of Units 1 and 4.24

This is an example of why we need to commit to building a fleet of reactors, with multiple units per site – we get the required number of reactors coming online per year, while optimizing long term productivity. Think Big.

The cost of the parts and materials needed to construct a nuclear plant today is much higher than it was the early 1970s. Consider this: “An analysis by EPRI found that nuclear-grade components were in some cases 50x more expensive than off-the-shelf industrial-grade ones.”25, see figure 10 below.

Nuclear-grade parts and materials are not necessarily any different or better than industrial-grade but cost significantly more. This is due to the immense amount of testing, quality assurance, and documentation necessary to achieve the nuclear-grade designation. These costs can be reduced by making regulations more flexible and establishing a healthy, large scale nuclear industry, with mature and highly competitive supply chains. Again, think big.

The indirect construction cost includes engineering services, construction management, administrative overhead, project management, construction supervision, licensing and regulatory compliance activities, quality assurance and quality control processes, and documentation and testing requirements.

The percentage of indirect construction cost of the total construction cost is a useful measure of overall productivity. This should be as low as possible. For NOAK AP1000 we assume it will be 40%. In the early days it was closer to 30%. In the post-TMI accident days it rose to about 72%. For a natural gas combined-cycle plant it is typically 10%-20%.

This cost rose from its early base due to complying with new regulations, regulations applied retroactively during construction, and lack of experience building a new design (Vogtle 3 & 4). This cost is reduced with regulatory stability, and experience building standardized designs. Further reductions can be achieved by streamlining existing regulations.

Interest during construction is the difference between the total capital cost and the construction cost (direct + indirect). The assumption from the study is the total cost is 1.2 times the construction cost. This is consistent with a 4-5 year build period. This cost is reduced by adhering to the solutions recommended previously. The faster a plant is built, the lower this cost is. Additionally, it is crucial for policymakers to control monetary inflation, as it leads to higher interest rates.

Long-term financing is the highest cost component of building a nuclear power plant. This cost is lowered by lowering interest rates. Again, policy makes must control monetary inflation. Financing a project like a nuclear plant has a debt component and an equity component. The interest rate for the debt component is significantly lower than that of the equity component. For example, the debt portion could be 6%, while the equity portion could be 12%, for an average of 9%, assuming both portions are equal.

Building a stable and predictable nuclear industry will attract a higher portion of debt financing and thus lower interest rates. Equity holders take more risks; hence, they are entitled to a higher return. The government could also offer loan guarantees to reduce risk and attract more debt financing. As the industry matures, the guarantees can be eliminated.

Operation and maintenance (O&M) consist of wages for the employees who operate the plant, security, training, regulatory compliance, and routine maintenance activities. The best strategy to reduce this cost is to build large reactors with multiple units on a single site. The average cost of generating nuclear power in the US, excluding interest payments, for a single reactor site is about 41 $/MWh, while the cost for a multiple reactor site is about 28 $/MWh.26

To understand O&M costs for various scenarios of reactor configurations see table 5 below from this paper.27

The costs in table 5 are projected costs of O&M in $/MWh for future builds, using modern reactors. The trend is clear, larger reactors are cheaper, and more units per site are cheaper. Streamlining regulations can potentially lower O&M costs even more.

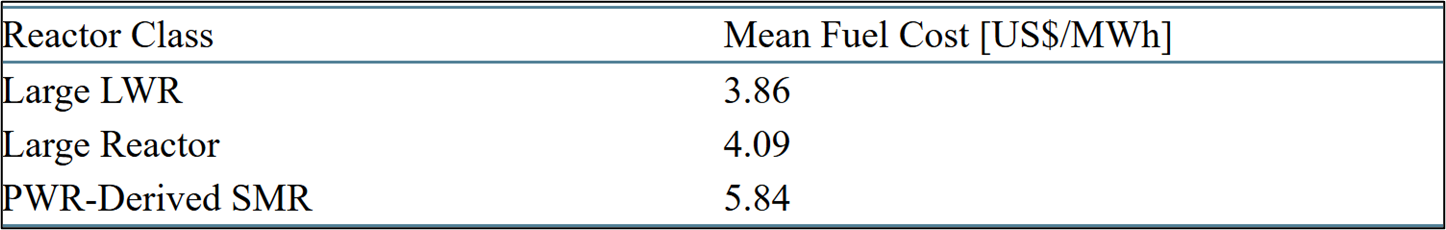

The Cost of fuel preparation is the cost of enriching the uranium then fabricating into fuel elements. This cost is lowered by preferring large reactors over small reactors. See table 6 below from this study.28

Table 6 shows that fuel costs are about 50% higher for small reactors compared to large reactors. The reasons large reactors have lower fuel costs include having a higher burn-up efficiency, less neutron leakage due to a larger core size, greater thermal efficiency, and benefiting from economies of scale.

The Cost of uranium is only 4% of the total cost. This fact informs us of the sustainability of nuclear power. In the distant future, we will move from mining higher grade uranium ore to lower grade, similar to copper. We may eventually pursue reprocessing and breeding. Furthermore, it’s been shown that there is enough uranium in seawater to power humans in perpetuity. This is because as uranium is extracted, the equilibrium is maintained when new uranium is leached from the bed of streams feeding the ocean.

Let’s say we were to adopt one or more alternative methods of acquiring uranium and this causes the price to quintuple. The increase will cause the retail price of electricity to rise by only about 1 cent/kWh. Electricity will still be quite affordable.

Cost of refurbishment includes the cost of replacing worn-out and corroded parts, and license extensions. This cost is less than 1%. This may seem too low but recall it is based on the net present value of lifetime refurbishments for the AP1000, and it is assumed to be zero for the first 30 years. This informs us that we should plan to operate a plant for as long as possible. The AP1000 is licensed to run for 60 years. However. It is eligible for extensions. It has been suggested that this design can run for 100 years. After the payoff period, that amounts to 27 MWh (2.7 cents/kWh) for reliable, emission-free power for 70 years! We became great by planning ahead – let’s start planning ahead again.

The MIT study does not address the financial risks of a major accident, or the costs associated with waste disposal. These two issues are often raised as a major concern of nuclear power; hence, we will analyze them next.

First, let’s consider the financial risk of a large-scale accident. The NRC estimates the probability of an AP1000 having a large scale release of radiation to be 1/51,282,051 per reactor, per year.29 Let’s assume the cost of such an accident is one trillion dollars ($82 billion spent on Fukushima as of 2022). Then the expected cost of the cleanup is $trillion/51,282,051 = $19,500 per reactor, per year. Eighty years of this implied cost, discounted to the present, amounts to 0.0021% of the total cost of an AP1000. Doubling or tripling the estimated cost of the cleanup isn’t going to make a material difference in the results.

Finally, let’s consider the cost of long-term waste disposal. A company called Deep Isolation plans to dispose of spent fuel by drilling deep boreholes below the water table, into sedimentary rock formations. These holes can be drilled almost anywhere, even on the grounds of a nuclear plant – the waste doesn’t even have to be moved.

This article suggests a lower limit of $2 million to drill one borehole.30 Let’s be conservative and assume the cost of drilling one hole is $4 million. This paper estimates that one of these holes can dispose of 150 metric tons of nuclear waste.31 An AP1000 creates about 34.4 metric tons of waste per year. Using these assumptions, the annual cost of disposal of waste from one AP1000 is about $916,989. Eighty years of this cost, discounted to the present, amounts to 0.10% of the total cost of an AP1000.

After about 300 years, due to exponential decay, the gamma radiation (which causes cancer) from spent fuel is reduced to a level where it no longer poses a cancer risk. It then predominantly emits alpha particles (helium). These are the same particles emitted when it was ore. The waste is then much more of a hazardous waste – it is only harmful if consumed. Thus, there is no significant long term safety issue with Deep Isolation’s solution.

Ironically, considering that the total quantity of nuclear waste is small, it decays exponentially, the cost of disposal is inexpensive, and it can be put deep into the ground with only a small diameter hole, waste disposal is an advantage of nuclear power compared to dealing with the large quantity of waste from renewables. The nuclear waste “problem” is a problem of poor communication.

Cost of small reactors

It is a common belief that building Small Modular Reactors (SMRs) is going to be cheaper and faster than building larger reactors. SMRs are typically defined as reactors greater than or equal to 50 MW, and less than or equal to 300 MW. The state of Illinois has outlawed the building of large reactors, while maintaining the legality of building SMRs. There are several projects in the US planning to build SMRs, but as of early 2025, there are none to build any large reactors. This is a mistake.

The argument for preferring SMRs is that since they are small, a higher percentage of their components can be built in a factory. The finished product can then be trucked out to a site and plugged in. It would be great if things were that simple. For one, this vision ignores the large costs for constructing the civil works. Nuclear reactors, large and small, have to survive aircraft impacts, earthquakes, hurricanes, and floods.

As of early 2025, the most popular SMR is the BWRX300. This is a 300 MW light water reactor made by GE. It is a scaled down version of their 1500 MW reactor called the ESBWR. Four units are planned for Ontario, Canada, the Tennessee Valley Authority is planning for a potential deployment, Poland is planning to build 24, and Estonia is considering a potential deployment. Note that no construction has begun for any of these potential deployments.

The DOE has a goal of building 200 GW of new nuclear power by 2050. According to this study32, the workforce required to meet this goal will be almost double for building BWRX300s vs AP1000s, and 30% larger for building SMRs made by NuScale. The study also found that a higher percentage of AP1000s can be built in factories compared to SMRs. Figure 10 below from the study shows the various alternatives.

The study uses cryptic names in figure 10; here is a translation:

“10-OAK LPSR” means 10th version of an AP1000.

“10-OAK SM-BWR” means 10th version of a BWRX300.

“10-OAK PWR-12” means 10th version of 12, 50 MW NuScale reactors.

Almost 60% of the AP1000 is built offsite – meaning built in factories. This is the highest of the alternatives. A disadvantage of smaller reactors is they have higher civil works costs, which must be done mostly on site. For example, a 12x50 MW NuScale Voygr reactor plant requires a significantly larger seismic category 1 building (earthquake-proof) than the AP1000, even though the AP1000 generates more power. The BWRX300 reactor building is about 1/3 the size of the ESBWR, but only outputs about 1/5 the power.

The MIT study cited previously for AP1000 related costs33, also predicts that the NOAK levelized cost of electricity for the BWRX300 will be about $95/MWh. This is almost 50% higher than the AP1000, which was about $66/MWh. While it can make sense to build the BWRX300 at this higher price, but only for applications that require less capacity than an AP1000.

Amazon and DOW Inc have announced an interest in building the Xe-100 made by X-energy. The Xe-100 is a high temperature gas cooled reactor which consists of four 80 MW reactors, for a total output of 320 MW. X-energy estimates that the overnight cost for each plant is between $4.75 to $5.75 billion. This equates to about $16,406/kW. This is a very high price, but to be fair, it is a FOAK price. However, manufacturers also tend to underestimate prices.

Another challenge is that the Xe-100 uses very expensive and hard to obtain High-Assay Low-Enriched Uranium (HALEU) TRISO fuel. The cost of fuel for an AP1000 is about $2,000/kg, while the cost of HALEU TRISO fuel is about $30,000/kg. Even when factoring in the higher fuel burnup rate and greater energy content of HALEU fuel, the fuel cost remains about 4.5 times higher. This gap may close with increased production of HALEU TRISO fuel, but that is a long way off.

The Xe-100 is expected to be ultra safe due to its use of melt-proof TRISO fuel, but as we saw earlier, so is the well-engineered AP1000. There is a possibility that due to nature of the melt-proof fuel, the civil works cost might be lower than the BWRX300. Possibly even lower than the AP1000, but that remains to be proven. The high capital cost cited by the manufacturer is not a good sign. To be clear, this is extremely exciting technology. Hopefully, the NRC will consider its inherent safety which should require smaller safety related civil works structures.

Reactors like the high temperature Xe-100 will play a critical role in the energy transition, but not necessarily to make electricity at scale. Industry burns large amounts of fossil fuel to make process heat for various industrial applications. High temperature reactors can eventually supply heat to industry at comparable prices to gas, and at a fraction of the price of intermittent energy, using resistance heating.

There are countless other kinds of SMRs, but the cost analysis is similar. Large reactors have the advantage of economies of scale. While there are plausible arguments that SMRs can eventually be cost competitive, the large light water reactors are proven technologies. It is an error to wait for something “better” to come along. We could be waiting for a long time – reactor development is extremely slow with many dead ends. Many reactors that worked well on paper didn’t fare so well when they were actually built. It took decades of continuous improvement to get the capacity factor of light water reactors over 90%. We should emphasis what works today, while developing better solutions for tomorrow.

Streamline regulation

With industrial learning the NOAK cost of electricity from a large, modern reactor is predicted to be about $66 MWh. Perhaps even a bit lower by clustering multiple reactors per site and other optimizations. While this is affordable to power an electricity grid, it is still too expensive for a broader decarbonization. We need a cheaper source of electricity to make synthetic fuels, concrete, fertilizer, plastics, chemicals, and steel. For example, making CO2 free steel with electricity at $66 MWh will almost double the cost compared to making it in a blast furnace.34

To achieve the price levels necessary for a rapid and affordable energy transition, we will need regulatory reform. There is wide agreement that the current regulatory framework is too inflexible. A study from Idaho National Labs proposes 13 very practical reforms.35 Below is a highly condensed and simplified summary of their findings. This author added a few comments.

Recall that NEPA is the National Environmental Policy Act. It is a law designed to protect the environment – not safety. The primary NEPA concern for nuclear energy is its clean, but warm water discharge.

[1] End uncontested mandatory hearings. A mandatory uncontested hearing (no third party is opposing anything) is a proceeding in which only the applicant and the NRC staff participate. These hearings must be held for each construction permit and combined license. In the past, these hearings have taken 4-7 months to complete, directly adding this delay to the licensing action.

[2] End the NRC's contested hearing opportunity on environmental topics to align with the traditional public comment and challenge process under NEPA. Currently, the NRC provides a broad opportunity for "affected" individuals to challenge any portion of an application based on environmental concerns, including environmental reports, construction permits, and licenses. This process exceeds the typical NEPA review practices for other federal actions, which normally involve public participation through scoping processes, comments on draft documents, and federal court challenges.

The NRC's contested hearing process can significantly delay licensing actions, potentially by a year or more, due to hearing and appeal activities. By adopting standard NEPA review practices, the NRC could streamline its environmental review process while still ensuring adequate public participation and environmental protection.

Comment – This appears to be an overreaction by the AEC and NRC stemming from the Calvert Cliffs’ decision.

[3] The NRC should adopt a simplified hearing process for contested new reactor licensing proceedings, replacing the current lengthy and costly procedures. While the Atomic Energy Act requires the opportunity to allow public challenges to new reactor applications, it doesn't specify how these hearings should be conducted. Currently, the process allows broad opportunities for public intervention, which can significantly delay licensing. For instance, in the North Anna Combined License proceeding, the applicant had to disclose 880 documents as part of the contested hearing process. A streamlined approach would maintain public participation rights while reducing unnecessary delays and costs in reactor licensing.

[4] Clarify the NRC’s mission statement from a singular safety focus to include the timely and efficient licensing of new nuclear projects. A slight modification to the statutory mission of the NRC to incorporate a timeliness and efficiency focus could greatly improve the speed and success of new reactor licensing activities and other NRC activities. This is similar to the mission statements of the FAA and FDA. The inclusion of a timely and efficient component in their missions does not appear to have had any detrimental impact on their safety missions.

Comment – This could change everything. For example, find ways to close the cost gap between nuclear and industrial grade materials without compromising safety.

[5] Reduce the excessive burden of Advisory Committee on Reactor Safeguards (ACRS) reviews by limiting its reviews to unique or new safety issues referred by the NRC as having significant hazard potential. The ACRS serves as an advisory committee to the NRC for a variety of topics identified in the Atomic Energy Act, but it can create excessive and redundant reviews to the licensing process. For example, NuScale has explained that during its design certification review for the NuScale SMR, the ACRS conducted some 40 meetings, totaling approximately 440 hours of in-person meeting time. The ACRS was formed before the NRC was established as an independent regulator, thus many of its reviews are now redundant.

[6] The NRC's current policy on public meetings significantly restricts non-public interactions between NRC staff and license applicants, requiring almost all substantive discussions to occur in public meetings. While this policy aims to promote transparency, it often leads to inefficiencies in the licensing review process. This approach can delay progress, as even minor clarifications require scheduling public meetings with at least 10 days’ notice. Congressional directions to permit more flexible engagement between NRC staff and applicants outside formal public meetings could significantly streamline the review process, reducing delays and costs without compromising public access to information.

[7] Exclude less than 20 megawatts thermal non-commercial reactor projects on DOE sites from NEPA. One of the most significant costs and burdens of new reactor licensing projects is compliance with the requirements of NEPA, which generally requires environmental review of federal actions. The NEPA review requirement can be particularly frustrating for projects which have very low likelihood of any significant environmental impact, such as smaller non-commercial reactor projects on existing DOE sites. These projects typically will only impact existing buildings or facilities, previously disturbed land, and well characterized areas.

Comment – If the US wants to lead in innovation, it is crucial for the DOE to be able to rapidly test new technologies.

[8] Formulate an external review team to shadow an entire NRC licensing review from start to finish and provide recommendations to further streamline the licensing process, including the appropriate application of the reasonable assurance standard. The Atomic Energy Act and the NRC mission focus on whether activities provide a “reasonable assurance” of adequate protection of public health and safety. The reasonable assurance standard for licensing actions has been applied too rigidly, resulting in a standard of essentially zero risk. This has led to excessively lengthy licensing reviews. This reasonable assurance standard should be clarified to ensure that it does not require absolute risk avoidance.

Comment – The only technology that will ever have zero risk, is one that is never built.

[9] Implement shorter milestones for licensing activities and require the NRC to revisit and improve these milestones annually. The Nuclear Energy Innovation and Modernization Act requires the NRC to develop performance metrics and milestone schedules for requested activities. Although there have been some improvements over previous types of NRC licensing activities, opportunities exist to substantially shorten these times even more, perhaps by half.

For example, there is a 30-month milestone for a combined license (build plus operating) for a light water reactor that already has a certified design. This is a 12-month improvement compared to a combined license milestone for a light water reactor without a certified design. A reactor design certified by the NRC, which itself is subject to a 36 or 42-month milestone, should include approval of the vast majority of issues. This rather marginal improvement in the timeline does not appear reasonable.

10] Clarify which non-commercial demonstration nuclear reactor projects may be authorized by the DOE vs licensed by the NRC. The DOE has the authorization to build and operate demonstration reactors without having to obtain an NRC license. This is important to streamline the process of developing and testing new reactor technologies. However, if a reactor placed on a national laboratory site is a “demonstration” reactor that is operated to demonstrate suitability for commercial application, it must be NRC licensed. This is true even if the reactor is not selling any of its power. Consistent with the Atomic Energy Act, projects constructed and operated at a national laboratory site that do not sell commercial power or any other commercial product (e.g., heat, hydrogen) should be allowed to proceed under DOE authorization, rather than NRC licensing.

[11] Modify the NRC fee structure for the licensing of new nuclear reactors or otherwise provide financial support for those projects. The NRC is required by law to recover approximately 90% of its annual budget, which it does through annual fees and hourly fees. Small companies with limited financial assets that have invented new reactor technologies are burdened with large licensing fees. For example, NuScale spent over $500 million to develop the information needed for its Design Certification Application. Congress could directly appropriate funds to cover the licensing costs associated with projects that it encourages for the national good.

[12] Permit foreign investment by US allies in US nuclear projects. The Calvert Cliffs Unit 3 Combined License was stopped due to indirect French foreign ownership. The South Texas Project Units 3 & 4 Combined License also faced a contested hearing due to partial, indirect Japanese foreign ownership.

[13] Indefinitely extend the Price-Anderson Act coverage for nuclear hazards. The Price-Anderson Act mandates the creation of a pool of funds from the nuclear industry to cover claims from nuclear accidents up to $13 billion. In the event of an accident causing damage beyond these limits, the federal government may provide additional compensation. This legislation limits the liability of operators, removing a deterrent to private sector participation in nuclear power programs.

Comment – We saw earlier that the expected cost of a major accident is extremely low, thus this is would not be a significant financial risk to the public.

Finally, consider a paper written by Nuclear Innovation Alliance concerning NEPA.36 According to the paper, NEPA reviews can require about a third or more of the NRC’s staff effort. Even though the law hasn’t changed since its inception in 1970, the NRC’s implementation grows more complex over time. See figure 11 below.

It is hard to understand how a law meant to protect the environment could have caused so much damage to the one technology that has the best chance of saving it. Clearly, the NRC needs a new mandate.

The plan to make nuclear power cheap again

Build standardized and modular designs – This goal has been largely accomplished since we now have several standardized reactor designs ready for construction.

Commit to building a fleet of AP1000s as a first step – To achieve NOAK pricing, we need a permanent, highly skilled workforce and supply chains specializing in building nuclear power plants. We will not achieve this by building only a few units. The advantage of the AP1000 is that it is fully licensed, we have experience building it, and since it’s a global standard, we will have access to international supply chains.

Cluster plants together and stagger their starting build dates – This approach helps achieve economies of scale, while optimizing labor and equipment productivity, and reducing pressure to find skilled workers.

Build on sites with pre-existing nuclear plants – The prices will be cheaper due to bulk purchasing, shared resources, pre-existing infrastructure, pre-existing workforce, site readiness, easier permit acquisition, and existing community relations.

Price guarantee program to achieve NOAK – Utilities are hesitant to build large reactors due to the financial risks of cost uncertainties. A price guarantee will mitigate these risks. Once NOAK is near, the guarantees will no longer be needed.

Emphasize large reactors over SMRs – While SMRs are suitable for smaller applications, large reactors should provide most of the power. Due to economies of scale, for the foreseeable future large reactors will have lower capital, O&M, and fuel costs.

Build high-temperature reactors for industry – High-temperature reactors can provide process heat to industry at competitive prices compared to gas and a fraction of the cost of intermittent energy.

Streamline regulations – Regulations need to be more flexible to achieve the lowest possible price. The NRC’s mission should include the timely and efficient licensing of new nuclear projects, akin to other safety-focused federal agencies like the FAA and FDA.

Policymakers must control monetary inflation – Financing is the most expensive component of nuclear energy. Inflation significantly contributed to the decline of nuclear power in the US.

Improve communication of nuclear power-related issues – Communicate accurate information about waste, safety, and the need for clean, inexpensive, and reliable electricity to the public. An informed and enthusiastic public will make it easier for policymakers to implement pro-nuclear policies, and utilities will face less resistance in building new plants.

Return to nuclear innovation – In the early days, the US invested in various reactor technologies: molten salt, breeder, fast, gas-cooled, heavy water, and thorium reactors. Build proven reactors for today while developing advanced reactors for the future.

Metrics of Success

Plant construction time is declining.

The cost gap between nuclear-grade and industrial-grade materials is closing.

The percentage of indirect construction costs is declining.

The ratio of debt to equity financing is increasing.

Conclusion

The three primary ingredients needed to make a nuclear plant are concrete, steel, and labor. The cost of each of these ingredients, adjusted for inflation, is cheaper today than it was in 1971 – the year Palisades came online. Yet, the cost of Vogtle 3 was 15 times more expensive than Palisades. If we are going to prosper as a nation, we must learn how to build big projects again.

If the price of nuclear power can be brought down to what it was in the pre-TMI accident days, decarbonization of the grid will happen in the blink of an eye – just like it did in France. The cost of nuclear power will be comparable to the cost of natural gas combined cycle. The market will choose nuclear power because it wants clean power, but only if it is reliable and affordable. Intermittent energy is neither. The job of the government is to start the fire. This can be done with temporary price guarantees to achieve NOAK and regulatory reforms – the market will figure out the rest.

The energy transition is failing. Global CO2 emissions in 2023 broke an all-time record. They will likely break new records in the years to come. Insanity is doing the same thing over and over but expecting a different result. We need a new plan – the current plan has failed. Nuclear power gives everyone what they want. For progressives, it eliminates CO2 emissions. For conservatives, it provides the most secure way to power a nation. For workers, it provides high paying blue collar jobs. For capitalists, it provides a reliable way to power their companies. For nature, it destroys the least amount of habitat.

The cost of nuclear power is a choice.

Very comprehensive work, thank you for all this stuff!

A good informative writeup, I assume it is correct.

I have long been a fan of nuclear though with caveats. The idea of reducing regulations to reduce cost is not a new one. However the industry has not been a good steward of safety and tends to carp about regulations. As you pont out TMI was an inflection point but the so-called activists were mostly ordinary citizens who didn't want to become irradiated. Nuclear accidents unlike other industrial accidents leave vast areas uninhabitable. This cannot be expressed merely in terms of costs.

It is in encouraging to hear an advocate admit that factors other than 'activists' such as rising interest rates, capital costs, and financial risk aversion, and a serious contributed to the failure of the American nuclear industry. After-all France was able to sustain substantial growrh in nuclear at the time I presume because there was a higher level of trust in their reactors' safety.

I am not so sure that the success of two AP1000 reactors in Pakistan is reassuring. The regulatory and inspection environment I would hazard is not very robust and subject to higher levels of corruption than the US. We do not know what shortcuts were taken. China probably does not have much concern abou the lives in other countries compared to their own.

I continue to be concerned about the amount of uranium required to fuel all of our energy needs which continues to expand at an astonishing rate. Diminishing ore yields does not sound promising. We seem doomed to grub up the entire continent in our inexhaustible search for resources. I like forests and clean air.

I find it ironic that when one common complaint of solar is that it is a diffuse energy source while counter is one that exists at 3 micrograms per liter in the ocean. And I thought 'boiling the ocean' was just a metaphor. Whether this is a vaible source remains to be seen. I have waited my entire life for nuclear fusion. Still waiting.

Without a reduction in demand for energy we seem doomed. I have become a convert to the idea of the carbon pulse. Which increasingly looks like a once in a planet endowment which we are squandering. As a race I suspect we will return within a few hundred years to wood for fuel and muscle for power which seems to be the only sustainable energy on this planet.

We could take our endowment put ourselves on different plane of sustainable energy but politically there will never be the will.

Sorrry for the ramble. I like the thoughts you present and the data to support it.